The Federal Open Market Committee (FOMC) decision to pause hikes on the benchmark interest rates has left many investors counting losses. Ethereum invalidated the positive market sentiment that had been building following reports of easing inflation in the US with losses amounting to 5.8% in 24 hours, to trade at $1,638 on Thursday.

Ethereum DeFi TVL Shrinks by $7.84B in One Year

Ethereum, the time-tested pioneer in the DeFi realm, has experienced a tumultuous journey with regard to its Total Value Locked (TVL). Though it has shown resilience in the face of shifting market tides, Ethereum’s position has faced formidable challenges from rising stars in the space like Optimism (OP), Tron (TRX), Solana (SOL), and Polygon (MATIC) among others.

Since June 2022, Ethereum’s dominance in the DeFi sector has been increasingly contested. Layer-2 solutions like Polygon have seen a considerable surge in TVL, thanks in large part to their ability to provide faster and cheaper transactions.

This has inevitably impacted Ethereum’s position, prompting a reevaluation of its supremacy in the DeFi landscape. According to the latest data on the DeFi space by DefiLlama, the network’s TVL has since June 15 lost $7.84 billion.

If the rout continues, the TVL may drop further from the current $24.36 billion, thus fading in comparison to Ethereum’s all-time high of approximately $108 billion in November 2021.

Liquid staking platform Lido accounts for the highest TVL in Ether’s ecosystem at $12.65 billion. MakerDAO comes in second place with less than half of Lido’s at $5.47 billion, while Aave, Curve Finance, and Uniswap fill the rest of the top five positions in that order.

The extensive crypto winter is the biggest challenge to investors in DeFi. As the market wobbles they are forced to pull their staked holdings to diversify their portfolios. Unfortunately, this situation increases overhead pressure for DeFi protocols like Ethereum.

Ethereum Price Downtrend Seems Unstoppable

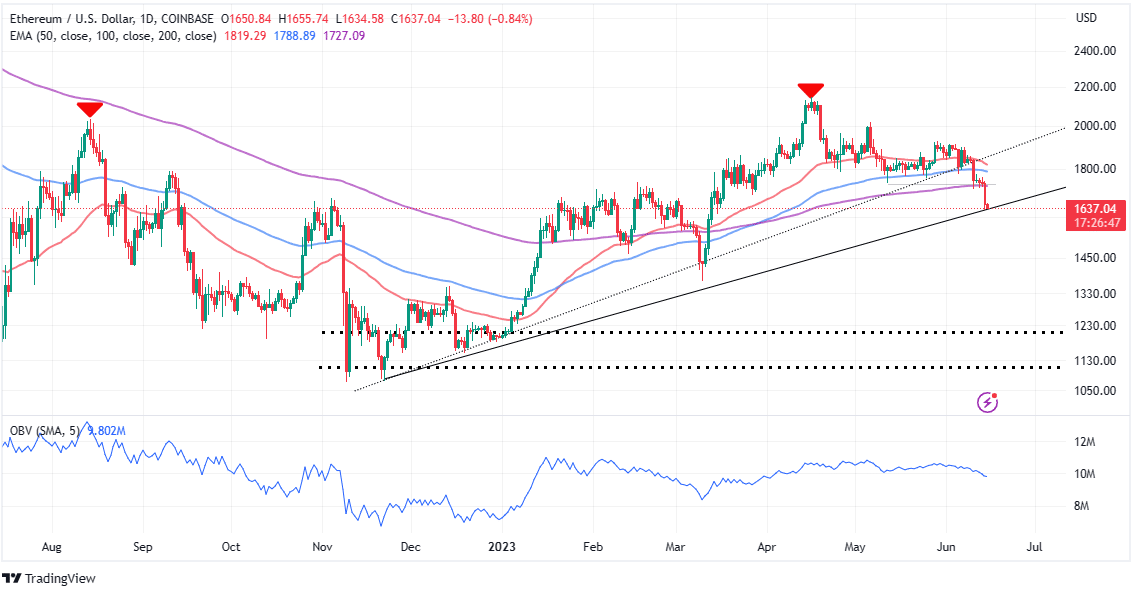

The daily chart shows bears aggressively working to validate another drop below the lower ascending trendline. Ethereum price has been vulnerable to declines since early last week when the US regulator, the Securities and Exchange Commission (SEC) launched a series of attacks on crypto entities and tokens – suing Binance and Coinbase.

If ETH price sustains movement below the lower ascending trend line or support at $1,600, it would be an uphill task for bulls to arrest declines before they reach $1,450. Already the On Balance Volume (OBV) indicator, which measures the inflow and outflow of volume in the market, shows sellers resolutely holding the reins.

All the applied moving averages including the 50-day Exponential Moving Average (EMA), the 100-day EMA, and the 50-day EMA hold above Ethereum price. A death cross pattern may come into the picture if losses extend into the weekend, with the 50-day EMA (red) crossing below the 100-day EMA (blue).

Traders considering buying the dip must wait for a confirmed rebound from the short-term support at $1,630, reinforced by the lower ascending trendline. Another buyer congestion holds at $1,600 as the last line of defense to prevent all hell from breaking lose to $1,450.

Ethereum price is bound to stay vulnerable until resistance at $1,800 is reclaimed for a continued upswing to $2,000 and beyond.

Related Articles:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.