Bitcoin price has all of a sudden faced a significant surge in selling pressure in the aftermath of June’s United States Federal Open Market Committee (FOMC) meeting minutes.

The consensus among officials during the meeting leaned towards maintaining the current interest rates, though a few suggested a slight increment of 25 basis points. In the foreseeable future, particularly in 2023, the vast majority of the committee anticipates further escalations in rate hikes.

The largest cryptocurrency is down 1.1% to $30,500 on Thursday, while the second-largest crypto, Ethereum, has, in the last 24 hours, lost 1.4% to trade at $1,913. This pressure is not unique to BTC and ETH, considering a 1.2% dip in the total crypto market cap to $1.23 trillion.

Despite the slight drop, Bitcoin price is comfortably perching above the immediate support at $30,500, with much stronger support expected at $30,000. BTC exploded, reclaiming resistance at $31,000 in June, bolstered by multiple filings by companies wishing to offer a spot Bitcoin ETF.

Bitcoin Price Extends Breather as FOMC Dust Settles

Investors are likely to spend the next few days digesting the FOMC minutes, especially as “almost all participants noted in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate.”

Meanwhile, it remains of great importance that Bitcoin maintains its position above $30,000. A confirmed slip below this level would open a can of worms. Remember, market sentiment has been improving over the last few weeks, held together by the surge in interest among institutional investors like Blackrock and Fidelity Investments.

A slight disruption of the enhanced market sentiment could trigger a sell-off amid widespread discontentment among retail investors, who are known for following the trend.

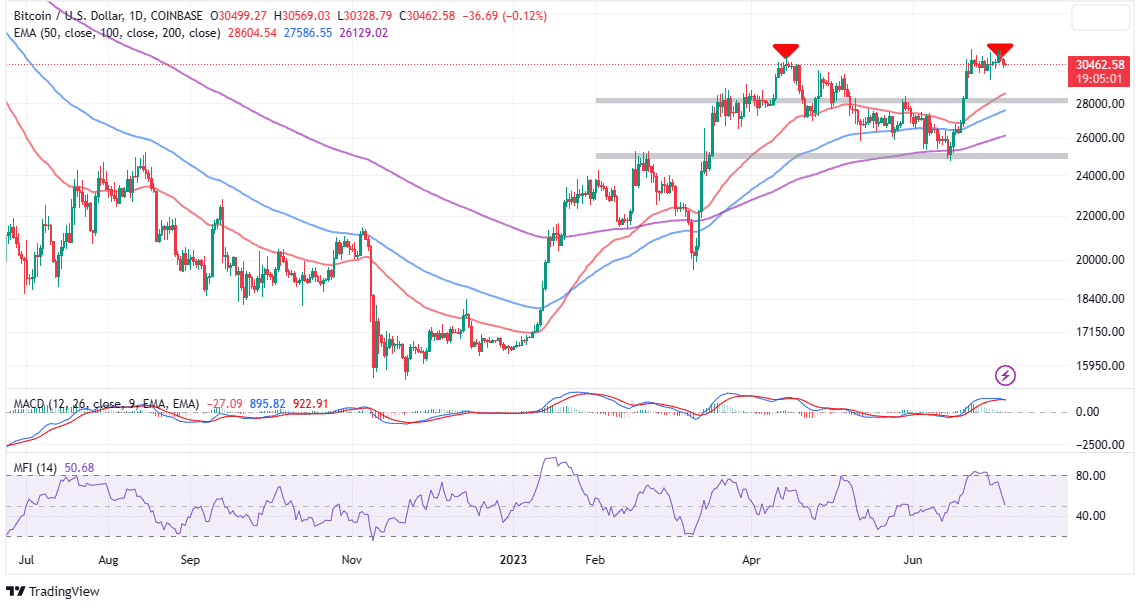

That said, there is a huge possibility of the Moving Average Convergence Divergence (MACD) indicator flashing a sell signal in the coming sessions – perhaps ahead of the weekend.

The call to sell BTC would manifest as the MACD line in blue crosses above the signal line in red. A double top pattern on the same daily chart could increase the chances of Bitcoin retracing below $30,000.

Another bearish signal stems from the Money Flow Index (MFI), which tracks the volume of funds entering and exiting BTC markets. A sharp slump, as the one observed below the chart, implies that outflow volume significantly dwarfs inflow volume.

In other words, there is more selling volume compared to the prevailing buying volume – a situation likely to keep Bitcoin price depressed and unable to take down resistance at $31,000.

In Other News: Crypto is Digital Gold – Blackrock CEO

Blackrock CEO Larry Fink has, in his latest interview with Fox Business, expounded on the spot BTC ETF filing with the SEC in June. According to Fink, the leading global asset manager is open and ready to work with regulators to address issues that are likely to arise with the proposal.

“What we’re trying to do with crypto is make it more democratized and make it much cheaper for investors,” Fink told Fox Business.

While talking specifically about Bitcoin, the CEO referred to the largest crypto as “an international asset.” In his opinion, Blackrock is “a believer in the digitization of products.”

Despite his positive remarks, Bitcoin price slipped, testing support at $30,500 weighed down by the FOMC minutes, which suggest the possibility of a ‘mild’ recession in the US.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.