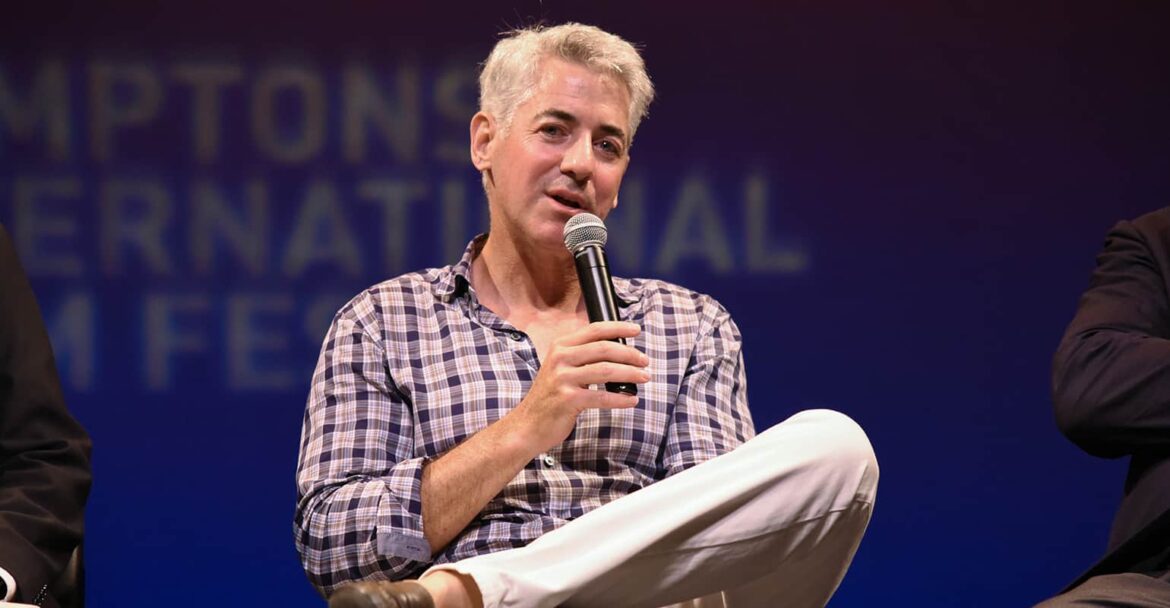

Crypto Market News: Even as yet another US regional bank PacWest Bancorp stock continues to drop, Pershing Square’s Bill Ackman is warning of further systemic risk in the US banking sector if quick corrective action is not taken. He said the banking system is at risk and the US regulators’ failure to improve insurance regime has “hammered more nails in the coffin,” a Bloomberg report quoted Ackman as saying. Meanwhile, the PacWest Bancorp stock is down by about 37% on Thursday, while the stock already lost over 42% value over the last five days.

Also Read: Crypto-Friendly TD Bank Terminates Merger Deal With First Horizon Bank

Bill Ackman Warns Of Risk To All US Banks

According to latest remarks by Ackman, the next weakest bank, in the current case PacWest could fall prey to the domino effect, at the back of the recent collapse of First Republic Bank. He added that no regional bank can survive bad news or bad data, amid constant fall in stock prices.

“As each domino falls, the next weakest bank begins to wobble. We are running out of time to fix the problem, we need a systemwide deposit guarantee regime now.”

The KBW Nasdaq Bank Index, a benchmark stock index of the banking sector, fell by over 5% over the last few days as the PacWest stock began to show signs of weakness.

Also Read: Top Media Demands Court to Release Data of 9M FTX Customers

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.