XRP price is standing tall against all odds, with 1.5% of accrued gains in 24 hours. The cross-border money remittance token, trading at $0.49 on Tuesday, has posted $886 million in trading volume with a market cap of approximately $26 billion.

A recent recovery attempt above $0.52 managed to step above $0.52 resistance but started to lose momentum momentarily. Although analysts have been calling for an extended retracement—one that would allow XRP to sweep fresh liquidity, bulls are adamant about losing their grip.

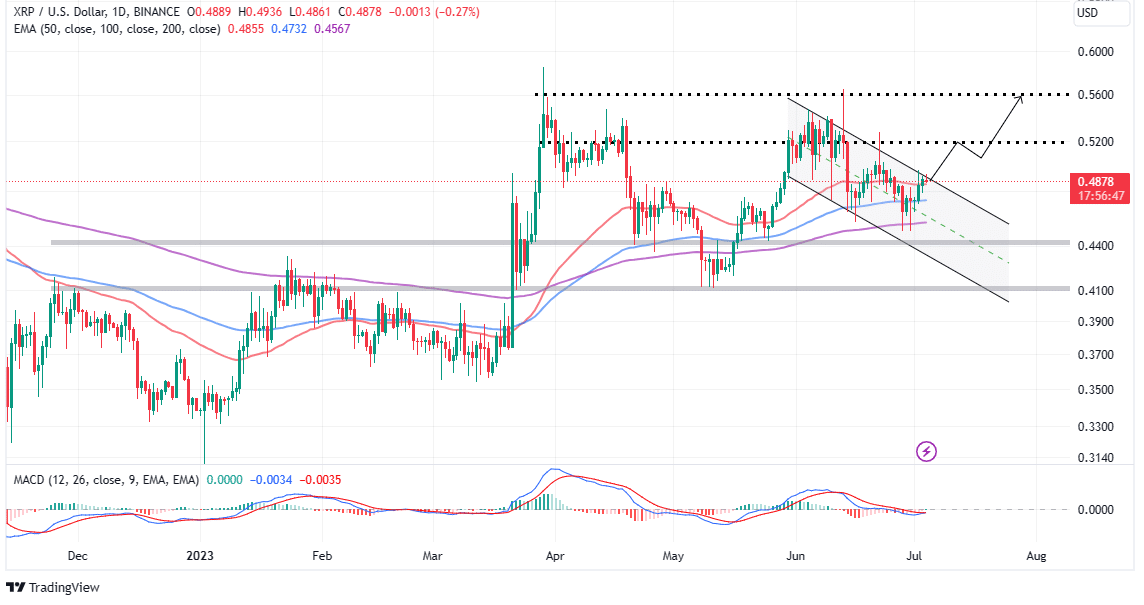

That said, XRP price upholds the support provided by the 50-day Exponential Moving Average (EMA) (in red), not to mention the immediate buyer congestion area at $0.48.

On the upside, a sustained break and hold above $0.5 are required to validate the uptrend and prove to the bears in the market that it is pointless to bet against a $1-bound uptrend.

Gains Seem Likely Above $0.5 As XRP Bulls Stay Put

XRP price is on the verge of a bull flag pattern breakout which came into the picture following the sharp rejection from highs around $0.55 in early June. The initial support, as highlighted by the 200-day EMA (purple), encouraged bulls to stay put in their positions.

As investors took advantage of the pullback to buy more XRP, a tail force gradually lifted the international money remittance token to close the gap to $0.5. However, XRP had already been caught up in the formation of the bull flag pattern, which, if validated, may send XRP to $0.56.

The bull flag pattern signals a strong uptrend in the market. Traders see the flagpole as a surge of buying pressure followed by a consolidation period.

Traders would anticipate a breakout above the flag’s upper boundary and place buy orders accordingly.

If executed appropriately and market conditions respond normally; traders aim to profit from the continuation of the bullish momentum and ride the next waves to $0.56 and $1.

Some of the cues investors may want to consider before buying XRP for short-term speculation is the incoming buy signal from the Moving Average Convergence Divergence (MACD) indicator.

Such a call to buy XRP would manifest with the MACD line in blue crossing above the signal line in red. This implies that the momentum behind XRP is growing, with a bullish breakout being the most likely outcome.

Citigroup Reconsiders Partnership with a Ripple-Acquired Company

As XRP tries to double down the efforts of bringing down resistance at $0.5 and $0.56 in order to pave the way for gains aiming for $1, Citigroup, a major bank, is reevaluating a partnership it has with a firm Ripple bought earlier in the year for $250 million.

According to a report by Bloomberg, Citigroup may cut ties with Switzerland-based fintech company Metaco. The report did not say whether the bank is distancing itself from Ripple.

Ripple has since December 2020 been battling a lawsuit with the US Securities and Exchange Commission (SEC) for allegedly selling XRP to investors as an unregistered security.

Metaco, on the other hand, focuses on providing asset tokenization services to help companies represent traditional assets on the blockchain.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.