XRP bulls are doubling down on the sudden market-wide recovery initially triggered by Bitcoin price’s uptick to $28,000. The cross-border money remittance token has in the last 24 hours, gained 3.7% bringing its cumulative weekly growth to 6.6%.

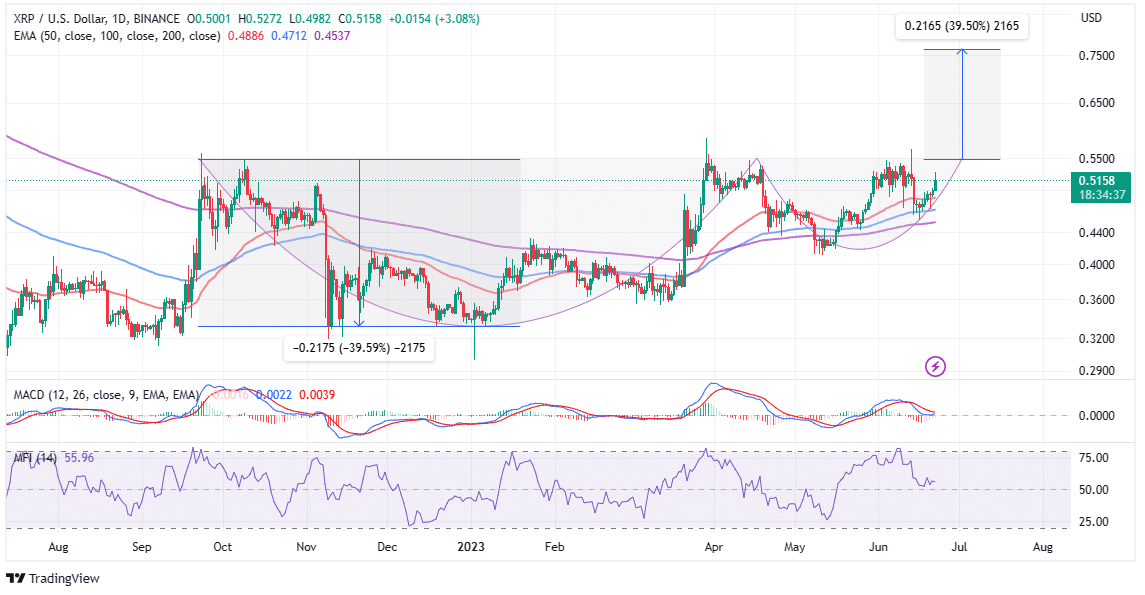

If this aggressive push by XRP bulls continues, the sixth-largest crypto, boasting $27 billion in market capitalization, may cultivate a cup and handle a breakout to $0.76. However, XRP price must first reclaim the $0.55 resistance to clear the path for the 39.5% breakout.

Ripple Bags Coveted Singapore Major Payments Institution License

Ripple continues to spread its wings across the globe despite battling a lawsuit for nearly three years.

The latest milestone has seen the international blockchain-powered payments network granted the in-principle approval on its application for a Major Payments Institution License from the Monetary Authority of Singapore.

We’re honored to obtain In-Principle Approval of a Major Payments Institution License from the @MAS_sg – allowing us to offer regulated digital asset products and services, and scale customer use of #ODL. 🇸🇬

Learn more: https://t.co/8Ylc3lZSeg

— Ripple (@Ripple) June 22, 2023

According to the latest market reports, this approval will enable a domestic affiliate to roll out authorized digital payment token solutions and offerings within the metropolitan state.

Simultaneously, the license will empower the firm to expand customer utilization of its crypto-facilitated On-Demand Liquidity (ODL) service, according to a company announcement on Wednesday evening.

Ripple uses this service to facilitate financial institutions to transfer funds globally in real-time, employing XRP as an intermediary currency.

Brad Garlinghouse, Ripple’s CEO in a statement regarding the in-principle approval said that Singapore “continues to be a global leader in establishing clear rules of the road to recognize the innovation and real-world utility of digital assets and its benefits to the global financial system.”

Ripple’s entrance into Singapore comes amid a strained relationship with US regulatory agencies like the Securities and Exchange Commission (SEC). Garlinghouse believes the SEC’s regulation-by-enforcement approach is out to stifle innovation in the US.

Beyond the determination of the case against the SEC, the CEO is calling for “a clear taxonomy and licensing framework.”

XRP Price On the Brink of a Cup and Handle Breakout

Now that XRP price has reclaimed resistance at $0.5 and is trading at $0.516 on Thursday, the path with the least resistance is to the upside. The formation of a cup and handle pattern, which CoinGape has highlighted before implies that XRP is approaching the point of no return.

In other words, if this cup and handle breakout is validated, it may propel XRP price to $0.76. Such a move is bound to bring the coveted psychological resistance at $1 within reach.

Moreover, a breakout of this magnitude, nearly 40% from $0.55 would call more buyers into the market—call it the fear of missing out (FOMO).

Adding credence to the bullish outlook is an incoming buy signal from the Moving Average Convergence Divergence (MACD) indicator. Traders yet to fill their long positions in XRP may want to ensure the MACD line in blue has flipped above the signal line in red before triggering the orders.

With XRP price sitting comfortably above the applied moving averages, starting with the 200-day EMA, the 100-day EMA, and the 50-day EMA, it is plausible to usher in a much more bullish weekend.

The Money Flow Index (MFI) as observed on the daily chart reveals that more funds are currently flowing into XRP markets compared to the money flowing out. This resembles a perfect situation for a rally in the coming few days.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.